Tax season can be a great time for a dealership to flourish with the right plan in place. We gathered dealers together to join in on the conversation on how tax season affects their dealership.

Tax season can be a great time for a dealership to flourish with the right plan in place. We gathered dealers together to join in on the conversation on how tax season affects their dealership.

At FIADA’s latest Member Mingle, GM’s and dealer principles shared their best practices, ideas and what to prepare for. We’ve compiled the top tips given on how to make the most out of tax season.

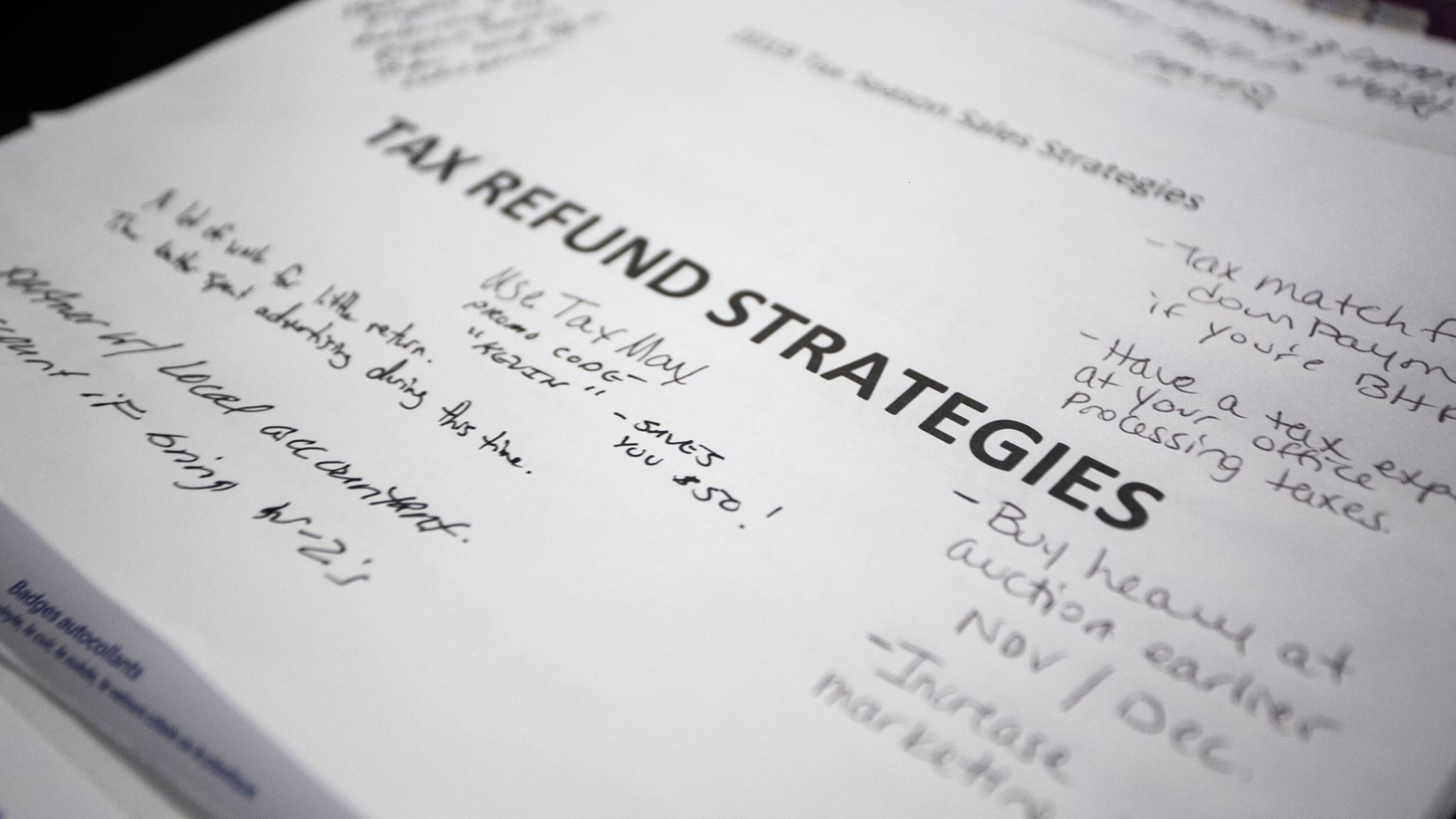

Tax Refund Strategies and Dealership Tips

Buy heavy at an auction in November and December. Don’t wait until January!

Partner with local tax accountants. Building your network is one of the best ways to maximize the resources you can have as a dealership.

Tax match for the down payment if you are a Buy Here Pay Here dealer. Make the buying experience easier.

Increase reviews for your dealership. Get customers to leave reviews before they leave with their car or offer bonuses to your employees that give site reviews for your dealership.

Use sales sites. Your customer reach doesn’t have to be limited to your physical location. There are plenty of online aggregators that can help get your inventory moving.

- OfferUp www.offerup.com

- LetGo us.letgo.com

- Car Gurus www.cargurus.com

- Auto Trader www.autotrader.com

Offer a gift. Who doesn’t love a bonus to their buy? Try offering a full tank of gas with an auto purchase to sweeten the deal.

Prepare your processes for a smooth customer experience. With the potential surge in business, it’s important to prepare the backend of your dealership to ensure an efficient post-purchase process. At OATA we process your tag and title work in high volume, fast. Check out our services catered to dealers or contact us to get started.

For more events, visit https://www.fiada.com/